PUBLIC UNIVERSITIES FACE GROWING FINANCIAL CHALLENGES THAT THREATEN EDUCATION, RESEARCH, AND SERVICE.

Here's how—and why—University of Iowa leaders plan to defend college affordability and accessibility for future Hawkeyes. COURTESY OF LILIáN SáNCHEZ GARCÍA

Lilián Sánchez García (pictured at right with sister, Alexia, and their mother) plans to study at the UI College of Law to become a lawyer in international law and advocate for human rights and victims of domestic violence.

COURTESY OF LILIáN SáNCHEZ GARCÍA

Lilián Sánchez García (pictured at right with sister, Alexia, and their mother) plans to study at the UI College of Law to become a lawyer in international law and advocate for human rights and victims of domestic violence.

Lilián Sánchez García's mom couldn't afford to stay in technical school. Her grandparents only had a third-grade education. Yet Lilián's family set clear expectations for her to attend and graduate college.

Raised in a single-parent household, Lilián watched her mother work long hours and multiple jobs to save money for her future. Her mom also sacrificed the familiarity of Mexico City to immigrate to Des Moines to provide better educational opportunities for her family.

Lilián didn't want to disappoint, but several barriers stood in the way of her college goals. In addition to their limited income, her mother wasn't fluent in the English language or American academic culture. Lilián would have to navigate this unchartered territory on her own. Even though she was a high achiever that any college would be pleased to attract, Lilián feared she didn't belong on a university campus. Like many first-generation college students, she struggled with "imposter syndrome"—feeling like a fraud in an environment where no one in her family had previously ventured.

Fortunately, with the help of high school counselors and mentors, Lilián filled out the intimidating 10-page Free Application for Federal Student Aid (FAFSA) form that determines student eligibility for federal grants, loans, and work-study funds. She applied to several universities, including Iowa State, Stanford, and Northwestern, but the University of Iowa's combined quality and affordability placed it at the top of her list. As Lilián ripped open an envelope from the UI Admissions Office, her eyes immediately landed on that life-changing word: "Congratulations."

"I started crying, jumping, yelling," she says. "I never thought it would be an option for me."

Now a UI junior studying political science and ethics and public policy, Lilián helps other underrepresented students fulfill their college dreams. She serves as a peer leader for UI programs that support the college transition of incoming Hawkeyes, such as Iowa Edge, LeaderShape, and the federally-sponsored TRiO (that includes Upward Bound and Student Support Services). Her personal experience has been invaluable to a 2016-17 freshman class made up of 19 percent minority students and 24 percent first-generation college students. Not only has Lilián mentored those undergraduates, but she also has represented student interests on President Bruce Harreld's financial aid advisory charter committee. In addition, she ran for vice president of the UI Student Government on a platform of college affordability—and won.

Still, Lilián worries that future Hawkeyes may not realize her same fortune. She watched in frustration as state lawmakers recently slashed the UI's budget by $15.46 million this year, leaving Iowa students and families to absorb the burden through a tuition hike this fall of at least five percent.

In total, this year's budgets for the UI, Iowa State, and the University of Northern Iowa were reduced by $30 million, with millions more cut for next year. Legislators blamed the budget shortfall on everything from low corn and soybean prices that hurt the state's agricultural economy to corporate tax relief programs that reduced revenues. Explains Iowa State Senator Charles Schneider, 02MBA, 02JD, chair of the Senate Appropriations Committee: "We can only work with what we're given. We can't spend more than we have. That's just the reality. That's not politics; that's math."

SOURCE: NATIONAL CENTER FOR EDUCATIONAL STATISTICS

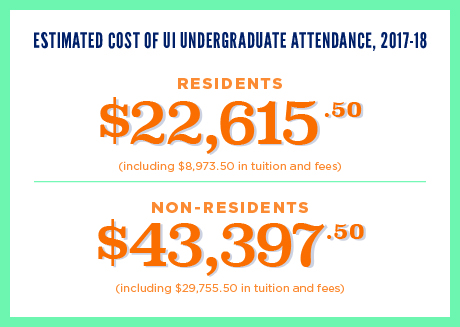

Estimated costs are for full-time undergraduate enrollment (12 or more hours per semester for the nine-month academic year).

SOURCE: UI OFFICE OF STUDENT FINANCIAL AID

Cost includes living on campus with tuition and fees, housing and meals, books and supplies, transportation, and personal expenses.

SOURCE: UI OFFICE OF STUDENT FINANCIAL AID

Cost includes living on campus with tuition and fees, housing and meals, books and supplies, transportation, and personal expenses.

According to research from the American Academy of Arts and Sciences, the main competition for states' expenditures comes from Medicaid. The cost of the low-income health insurance program has grown to 19.1 percent of the average state budget in 2014, while higher education has dipped from similar heights down to 9.4 percent. In the last three decades, corrections has surpassed higher education in the percent growth it receives of states' spending. Some states like California funnel more money into prisons than into their universities.

Because public universities are one of the few state programs that can tap into other sources of revenue like tuition, they often become the sacrificial lamb in tough economic times. Back in 1990, 64.3 percent of the UI's general education fund came from state appropriations, while 28 percent came from tuition. In 2017, that model has flipped to 31.6 percent state and 62.5 percent tuition.

Since 2000, virtually every state in the country has dramatically decreased its financial support for public universities. Former UI President Mary Sue Coleman, a vocal advocate for higher education as president of the Association of American Universities, calls this a "chilling" trend that could have dangerous consequences for the country's future. With the vast majority of American college students receiving their education from public institutions, she says, "It's an existential threat to the nation—a global threat—if we're not willing to support our universities."

For years, the UI has built a proud reputation on being a good value for students like Lilián seeking an affordable, quality college experience. In an era of rising tuition and diminishing state funding, how can Iowa maintain this legacy?

Past and present university leaders met on campus this past spring to address the issues of college affordability. Coleman was among them, joining Harreld and Jim Leach, the UI chair in public affairs and interim director of the UI Museum of Art, at the Lincoln Project Forum. A national initiative of the American Academy of Arts & Sciences, the forum was one of several held in college towns across the country for leaders in higher education, government, and business to brainstorm solutions to the financial challenges.

Harreld encouraged Iowans to support higher education as a "cornerstone of our democracy and our society that leads to lifelong learning and better citizens." The UI has educated teachers in all of the state's K-12 school districts, as well as 79 percent of the state's dentists and half of the state's physicians and pharmacists. Sharing these statistics, he emphasized the university's role in serving the public good and contributing to the health, well-being, and economic development of the state.

Not to mention the world. Leach praised the UI's influence in the lives of Donald "Mac" Showers, 44BA, a naval officer who cracked a Japanese code to help the U.S. secure an important victory in World War II, and astrophysicist James Van Allen, 36MS, 39PhD, who developed one of the greatest military inventions of all time—a radio proximity fuse that increased the accuracy of anti-aircraft missiles. Lauding these UI- educated heroes, Leach said, "The sciences that come out of here have saved America."

Because universities can spend more time on research than businesses that are driven by profit, their efforts have led to everything from the digital computer and smartphone technology to the sequencing of the human genome and potential cures for cancer.

In light of such extraordinary contributions, Coleman called for state legislators to make a long-term commitment to increase funding. Harreld agreed that such predictability could help the university soar in earning grants, build businesses from research endeavors, and create new programs and courses. Yet he seemed skeptical of Coleman's belief that public universities should be able to depend on state funds. "Hope is not a strategy," said Harreld, who sees an opportunity to better balance tuition and financial aid. "At some point, we need to have a plan B."

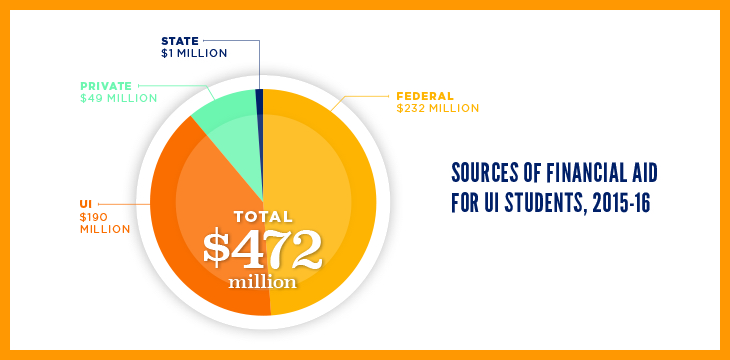

SOURCE: UI OFFICE OF STUDENT FINANCIAL AID

Financial aid includes scholarships, grants, employment, and student loans.

At the UI, 90 percent of undergraduates and 78 percent of the overall student population receive some type of nancial aid (which includes employment). Though not meant to cover the entire cost of college, the extra support helps put students' dreams within reach.

Like Harreld, former Iowa State Board of Regents President Bruce Rastetter, 78BA, believes lawmakers need to work on a long-term financial solution to retain the value of an Iowa education. If the state doesn't adequately fund the UI, Rastetter said the board would work to raise Iowa's tuition to the average of its national peers such as Ohio State ($10,010 in-state/$29,114 non-resident) and Wisconsin ($10,488/$34,738). Such a plan would gain $91 million for the UI's budget. But if not handled with care, it could also mean the loss of promising students like Lilián, who was initially drawn to the UI for its comparatively low tuition.

Iowa still has the lowest estimated cost of attendance in the Big Ten. Even so, Christopher Morphew, a UI professor and chair of the educational policy and leadership department who studies models for funding public universities, says for many struggling Iowa families, "The lowest tuition isn't low."

Despite Iowa's reputation for being affordable, Morphew found inadequacies with the state's historical approach of limiting tuition hikes without offering significant financial aid to help low-income families. He argues the strategy has only led to the UI and the state's other regent universities becoming "gated communities," where 60 percent of the student body comes from families in the top 20 percent of income earners.

Morphew agrees with Rastetter's approach to raise tuition to be in line with its national peers—but only if the plan goes a step further. He urges the UI to use the higher tuition it generates—primarily through the recruitment of out-of-state students who spend more on their education— to provide financial aid for lower-income Iowans. The state legislature could also adopt a policy that would allow the university to concentrate its financial aid program on improving accessibility, instead of providing scholarships for students whose families would send them to Iowa regardless of cost. Such a program would allow students like Lilián to benefit from a UI education, despite rising tuition.

A double major with three minors, Lilián says she's thankful she's been able to take advantage of all that Iowa has to offer—all while staying on track to graduate in four years. As a UISG senator, she has participated in the Hawkeye Caucus in Des Moines to share her success story and lobby legislators for their continued support. "Without financial aid, I wouldn't be here," she says. "If we continue to [decrease funding] in education, we're missing the opportunity to invest in students and society as a whole."

Grateful for the holistic education she's received at Iowa, Lilián's ready to move forward in her academic, personal, and professional life. "I've grown so much," she says. "The university has seen my value as a student and has allowed me to grow to my greatest potential through the leadership programs I've participated in. A lot of the skills I've gained are transferrable to the professional world."

Not only has her college experience set her up for success in her career path, but it's also opened the door for future generations of her family to follow in her footsteps. Already, Lilián's sister, Alexia, has joined her at Iowa as a senator on the UI Student Government. Far from experiencing "imposter syndrome," the Sánchez García family has found a place they belong.

Any comments? Email shelbi-thomas@uiowa.edu.

THE REALITIES OF COLLEGE DEBT

In spring 2012, President Barack Obama came to the UI campus to address the problem of college affordability.

Fortunately, about half of UI students graduate without any debt. But for those who do—according to the Institute for College Access & Success' Project on Student Debt—their average debt amounted to $28,771. On a national level, 68 percent of 2015 college graduates had student loan debt, averaging about $30,100 per borrower.

Five years since Obama's visit, one of the UI undergraduates who shared her concerns with him at a student roundtable says the burden of loans continues to weigh on her. Marissa Boles, 12BA, dreamed since she was a teenager of coming to the UI to become an educator. She has since attained both goals—but at a cost.

Boles juggled two jobs at times to help pay for her education. Since completing her master's degree in May 2016, she's worked as a school counselor in West Branch, Iowa.

Though Boles feels overwhelmed when she receives her monthly loan bill, the gratitude she has for her education helps put her struggles back in perspective. She says, "I can appreciate how lucky I am to have a bachelor's and master's degree, to be working at a job that I have dreamed about, and to have attended the University of Iowa."

Indeed, studies show a college degree is a long-term investment that typically leads to greater career prospects and income.

THE VALUE OF A LIBERAL ARTS EDUCATION

Bruce Harreld and Mary Sue Coleman weren't the only UI presidents on campus this past spring to advocate for higher education. Smithsonian Secretary David Skorton, who spent more than 26 years in Iowa City as an educator, researcher, administrator, physician, and musician, spoke at Hancher on the importance of integrating STEM (science, technology, engineering, and math) studies with the arts and humanities. Celebrating liberal arts education, the saxophone-playing heart doctor recognized the UI's distinguished history in this area as the first university to offer a master of fine arts degree.

"A life in science has taught me that science will not be enough to solve the world's thorniest challenges," Skorton said. "For that, we need the deep and broad value of the liberal arts for two overriding reasons: They hold inherent value as the best way to understand ourselves, our world, and what it means to be fully human, and they provide practical contributions to solving our most difficult and persistent problems."

MAKING A SOUND INVESTMENT

If students want federal aid for college, they'll need to fill out the FAFSA. Prospective Hawkeyes can now complete their FAFSA as early as Oct. 1, allowing more time than ever to determine whether Iowa is a sound financial choice for them.

"Choosing the right university is about finding the right fit—academic, social, geographic, and financial," says Director of UI Admissions Kirk Kluver. "All are important when considering which universities to visit as a prospective student. However, when it ultimately comes to making a decision, financial fit is often the most important factor."

Mark Warner, 71BA, 73MA, the UI assistant provost for enrollment management and director of financial aid who retires next month after nearly 45 years of serving students, says the university now offers more resources to families to help them make wise financial decisions about college. Families can use the net price calculator online (https://npc.collegeboard.org/student/app/uiowa) to estimate college costs, and students can meet one-on-one with UI financial literacy specialists throughout the school year.